The New Financial Capitalists

Kohlberg Kravis Roberts and the Creation of Corporate Value

in:

Investing

Summary:

The book delves into the history and business strategies of the private equity firm Kohlberg Kravis Roberts & Co. (KKR), exploring how the firm revolutionized the leveraged buyout (LBO) industry and impacted corporate management and restructuring. It examines case studies of KKR's significant deals and discusses the broader implications of their approach to creating corporate value through financial engineering and active management.

Key points:

1. LBOs and KKR: The book covers leveraged buyouts (LBOs), a method KKR uses to buy companies with debt and improve them for profit. It explains how LBOs can boost corporate value through better management.

Books similar to "The New Financial Capitalists":

Barbarians at the Gate

Bryan Burrough|John Helyar

King of Capital

David Carey|John E. Morris

The Private Equity Playbook

Adam Coffey

Warren Buffett Accounting Book

Stig Brodersen|Preston Pysh

Two and Twenty

Sachin Khajuria

HBR Guide to Buying a Small Business

Richard S. Ruback|Royce Yudkoff

Leveraged

Moritz Schularick

Strategy for the Corporate Level

Andrew Campbell|Michael Goold|Marcus Alexander|Jo Whitehead

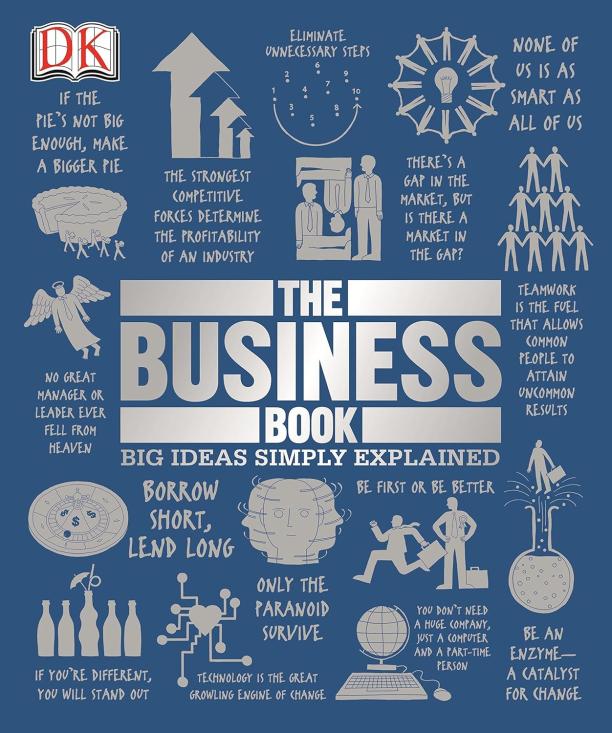

The Business Book

DK

The Outsiders

William Thorndike